wisconsin private party car sales tax

In Wisconsin the state sales tax rate of 5 applies to all car sales. Odometer reading if applicable.

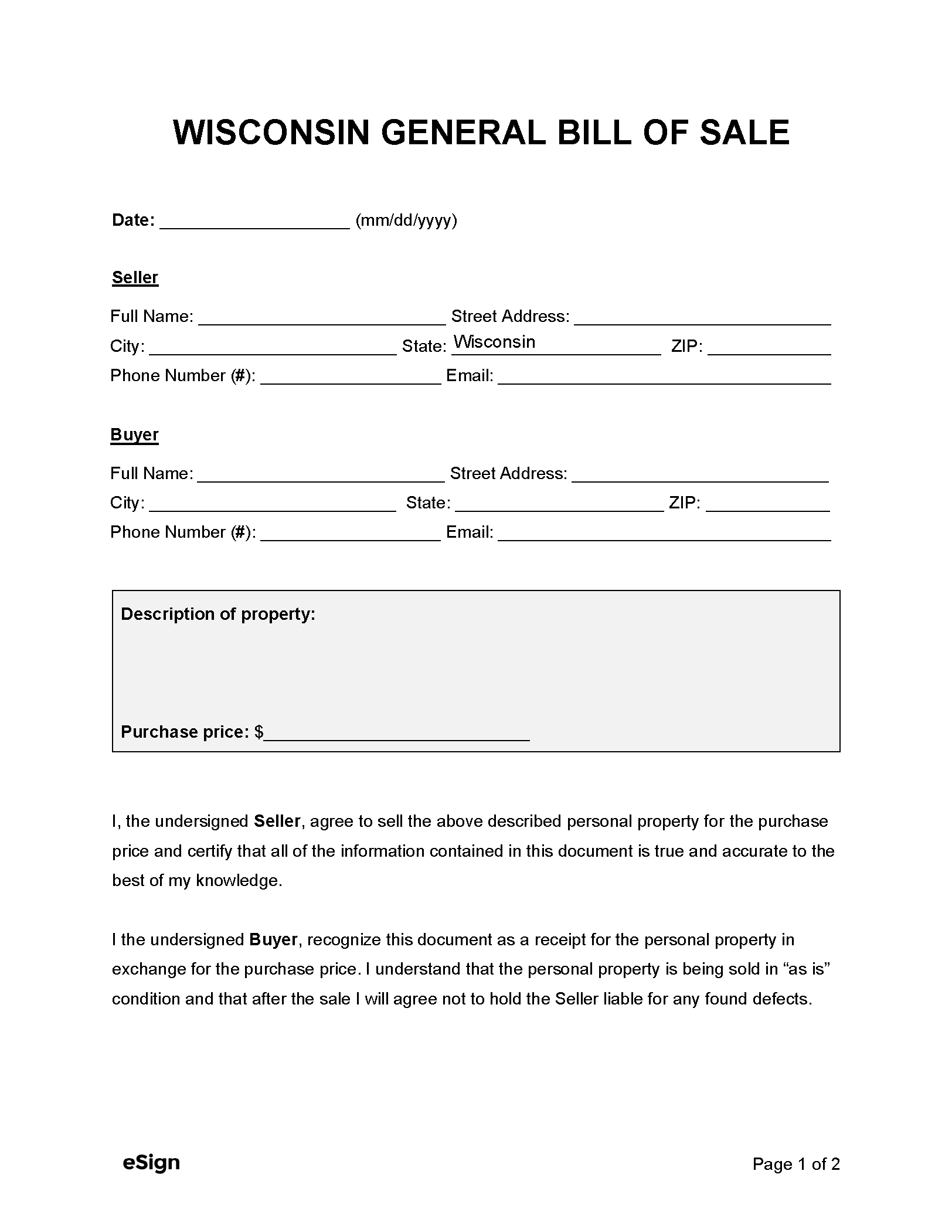

Free Wisconsin Bill Of Sale Forms Pdf Word

Proof of WI car insurance.

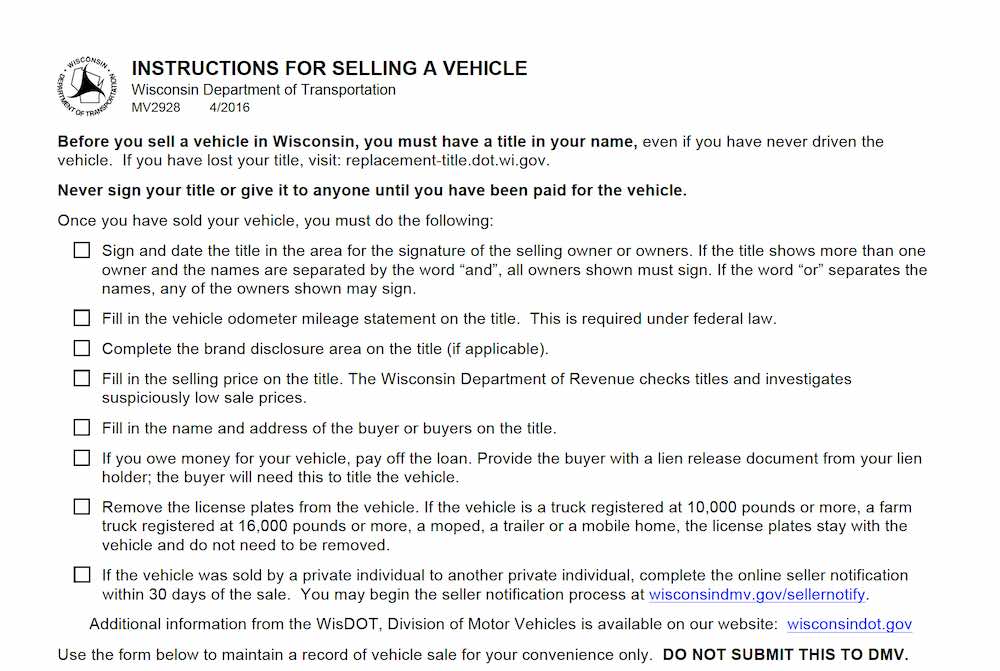

. When you buy a new-to-you. Get a dealer license to sell more than five vehicles a year. Wisconsin law says you can sell up to five vehicles titled in your name in 12 months.

The National Highway Traffic Safety Administrations NHTSA odometer disclosure requirements were updated in December 2020 impacting certain private vehicle sales in Wisconsin. Address 123 Main Street New York NY 10001. DOR Wisconsin Department of Revenue Portal.

If you have questions about how to proceed you can call the department at 608 266-1425. I purchased a car in Minnesota from a private party and live in Wisconsin Im aware when I register the vehicle and transfer title at the WI DMV Im required to pay Wisconsin sales tax. Are drop shipments subject to sales tax in Wisconsin.

There are also county taxes of up to 05 and a stadium tax of up to 01. But if the original sales price plus the improvements add up to 8000 and you sell the car for 10000 youll have to. Some dealerships also have the option to.

Payment for the fees due including. Standard fees charged by the state when purchasing a new vehicle in Wisconsin are. Lease or lienholder paperwork if applicable.

900AM500PM Saturday Sunday. Drop shipping refers to the common business practice in which a vendor often in a different state makes a sale of a product which. Car Sales Tax on Private Sales in Wisconsin.

Tax laws on private sales of used cars can vary from state to state. Call DOR at 608 266-2776 with any sales tax exemption questions. If you sell more than five or if you buy even.

A sales tax is required on all private vehicle sales in Wisconsin. Wisconsin collects a 5 state sales tax rate on the purchase of all vehicles. You may be penalized for fraudulent entries.

WI Drivers license or ID card. Still buying or selling a car privately has several perks a dealership cant offer. You may have to hire an attorney if the department cannot.

However if a vehicle purchased in another state the District of Columbia or the Commonwealth of Puerto Rico is subject to sales tax in that jurisdiction a credit against. As an example if you purchase a truck from a private party for. The Wisconsin Department of Revenue DOR reviews all tax exemptions.

16450 for an original title or title transfer.

Free Bill Of Sale Forms 24 Word Pdf Eforms

Wisconsin Car Registration Everything You Need To Know

Free Wisconsin Bill Of Sale Form Pdf Word Legaltemplates

Wisconsin Title Transfer Etags Vehicle Registration Title Services Driven By Technology

If I Buy A Car In Another State Where Do I Pay Sales Tax

Wisconsin Bill Of Sale Form Dmv Wi

What Are Dealer Fees Capital One Auto Navigator

Nj Car Sales Tax Everything You Need To Know

Free Wisconsin Bill Of Sale Forms Pdf

Free Vehicle Bill Of Sale Form For A Car Pdf Word Legal Templates

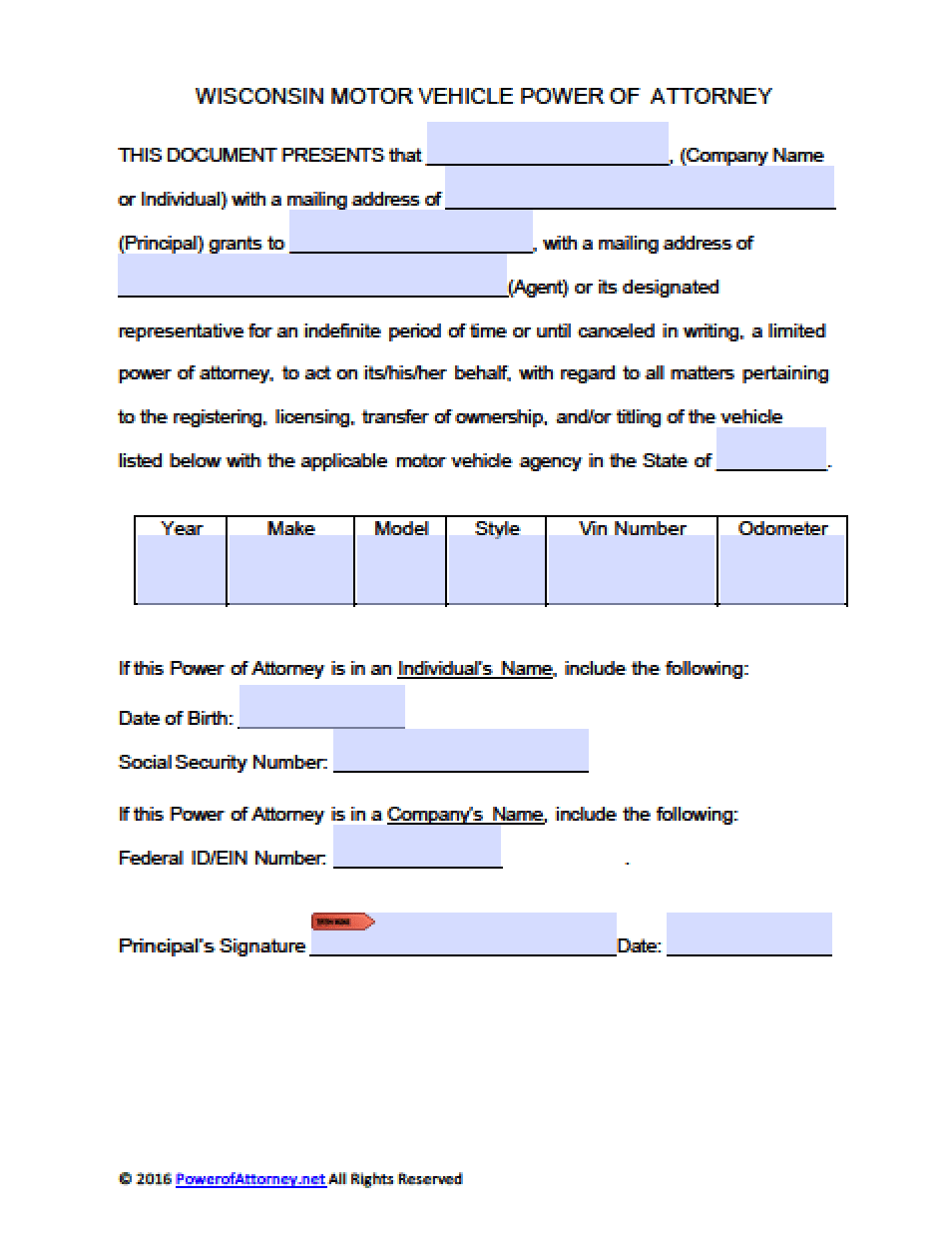

Wisconsin Vehicle Power Of Attorney Form Power Of Attorney Power Of Attorney

Sales Taxes In The United States Wikipedia

Do I Need To Pay Taxes On Private Sales Transactions Rocket Lawyer

Cheapest States To Buy A Car Forbes Advisor

Wisconsin Car Registration Everything You Need To Know